Summary Text

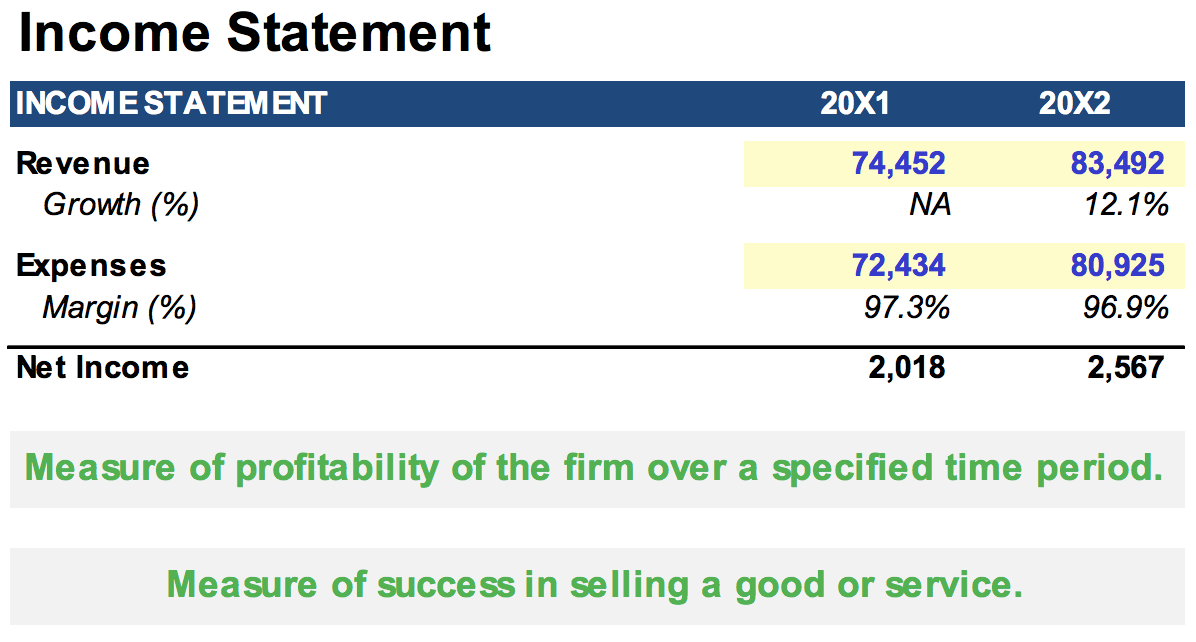

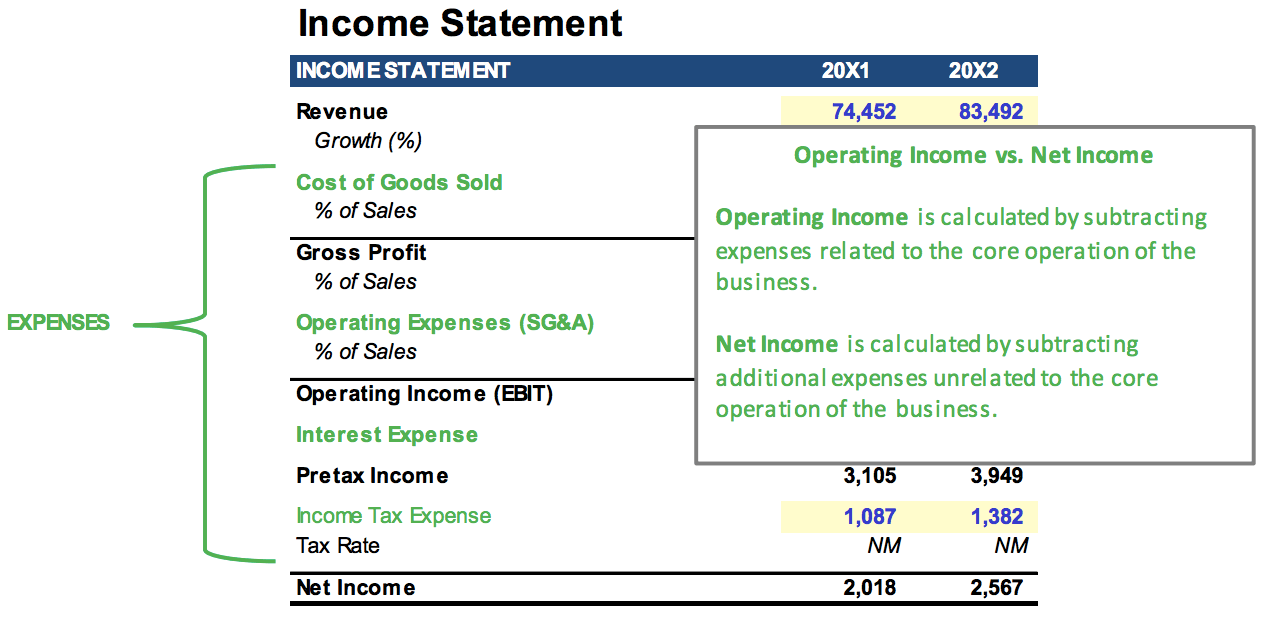

This video introduces the income statement. The video starts by showing the income statement in its most concise format as pictured below.

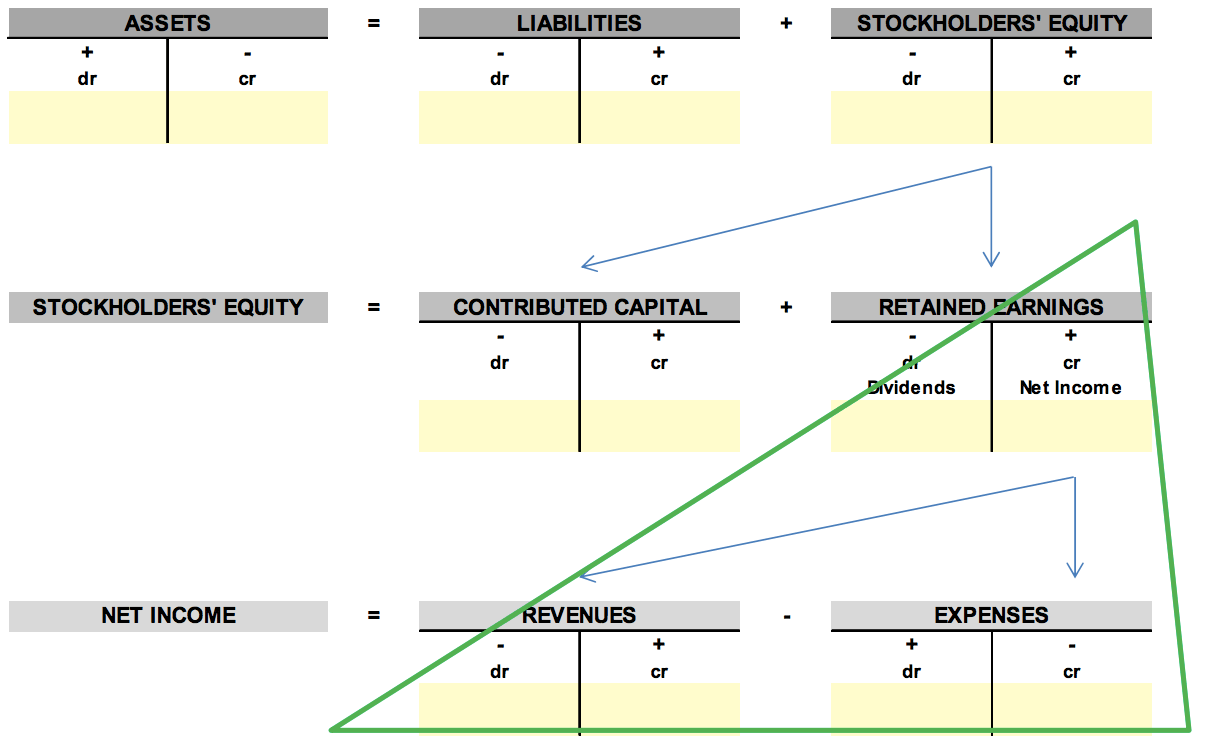

After this introduction the accounting equation is revisited to help illustrate how the balance sheet and income statement relate to one another. The most significant relationship here is that stockholders’ equity grows with net income.

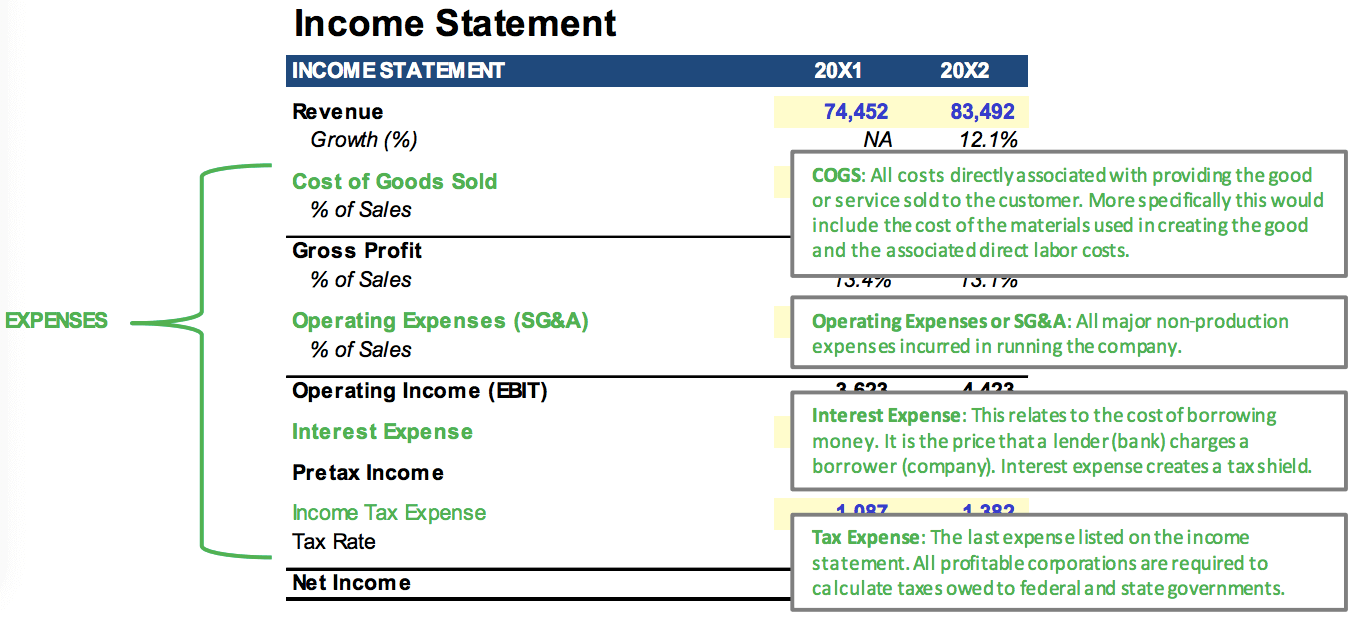

The video then elaborates on the various categories of expenses found on the income statement. The text has been included below as a reference.

NOT MENTIONED IN VIDEO: The text under interest expense concludes stating that interest expense creates a tax shield. This is not elaborated upon in the video, but tax shields (interest expense is not the only tax shield) are important and will be referenced in future videos. For the time being, all that is important is that interest expense is deducted from net income before tax expense is calculated, which results in a lower tax burden (tax shield).

On this tab the video focuses on the difference between operating income (or EBIT) and net income. The reason for making this distinction is that expenses that do not relate to the core operation of the business come after EBIT.

For this reason the gross profit margin and EBIT margin are more commonly referenced in analysis detailing a companies operations and profitability.

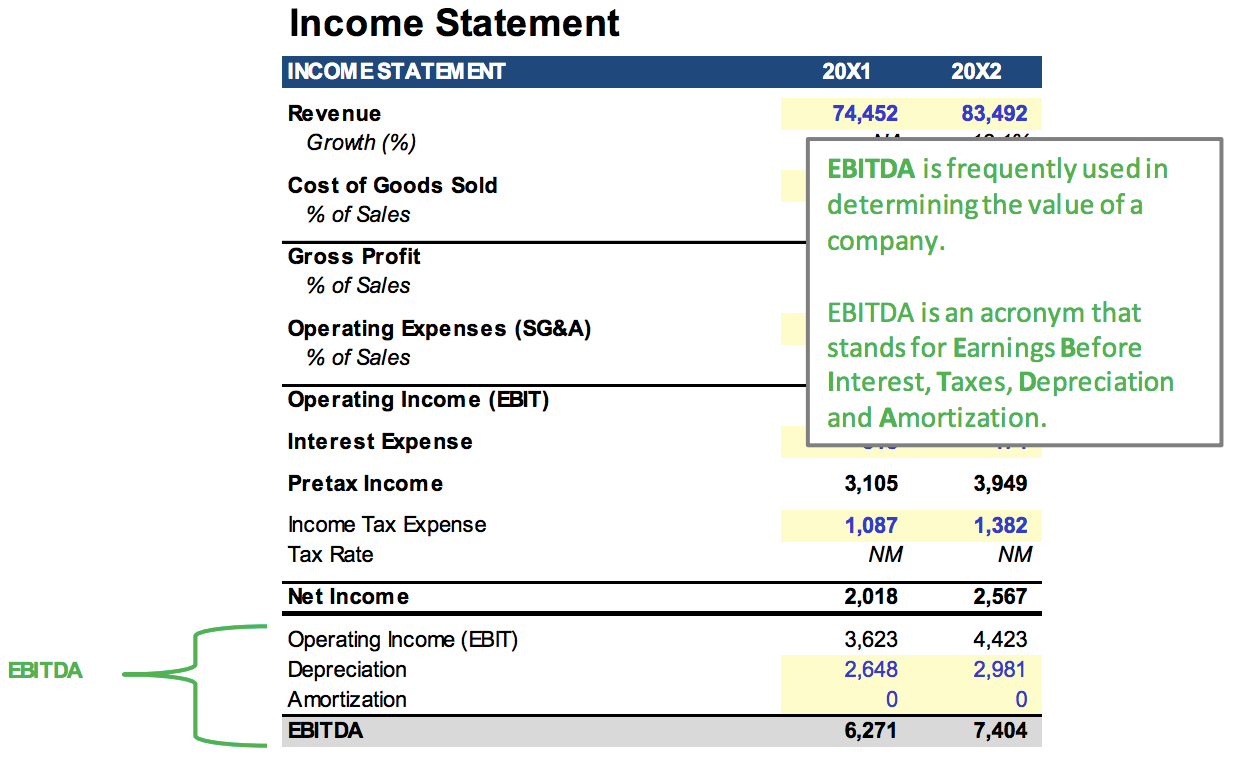

Continuing with measures of profitability, the video then references EBITDA. EBITDA is an acronym that stands for Earnings Before Interest, Taxes, Depreciation and Amortization. It is generally not found on a company’s income statement, but it is commonly referenced in most financial models because it is frequently used in determining the value of a company.

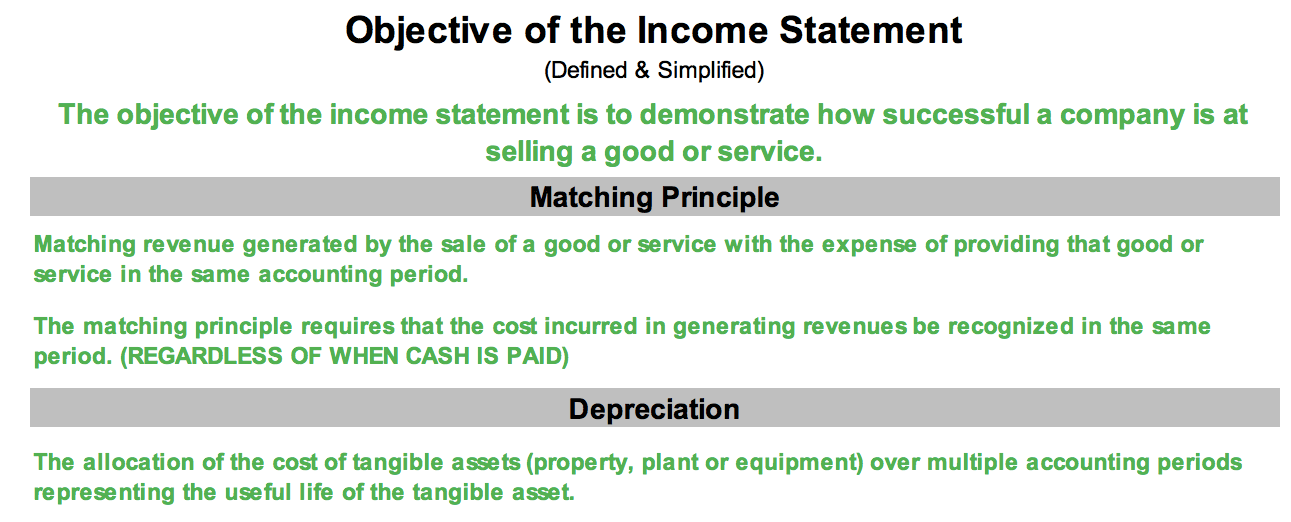

The objective of the income statement is then revisited to point out two important accounting concepts:

- The Matching Principle

- Depreciation

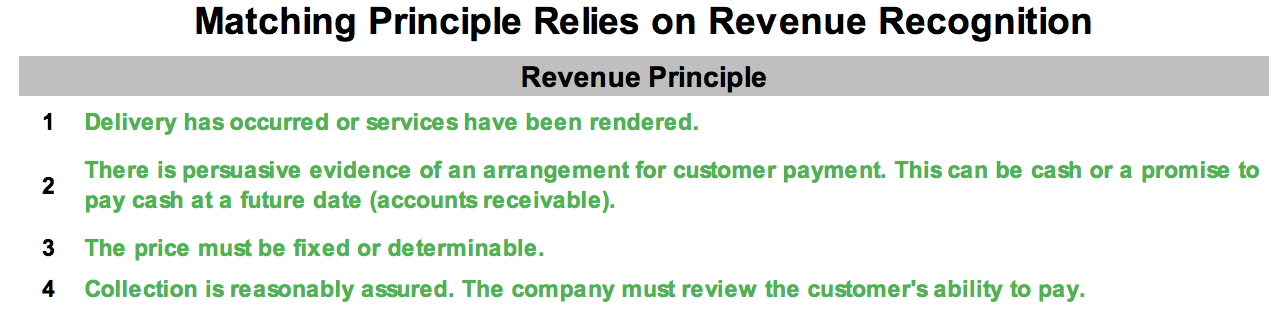

Because the matching principle requires that expenses be recorded when revenue is recognized, the video then details the four conditions required to recognize revenue.

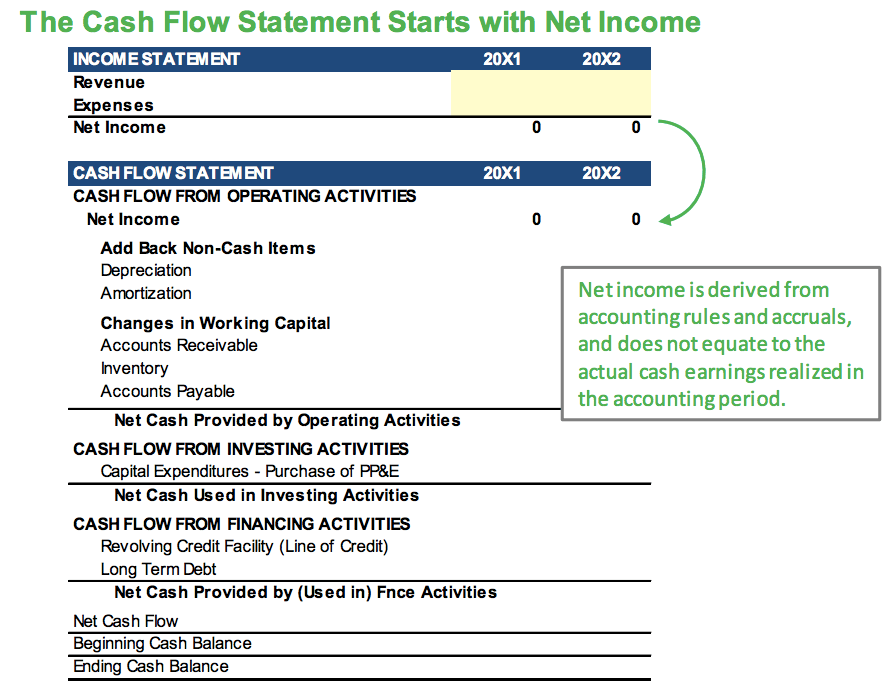

Another important relationship to keep in mind as you build financial models is that the cash flow statement starts with net income. The video demonstrates this relationship with the visual pictured below, and then by showing this link in a fully integrated financial model.

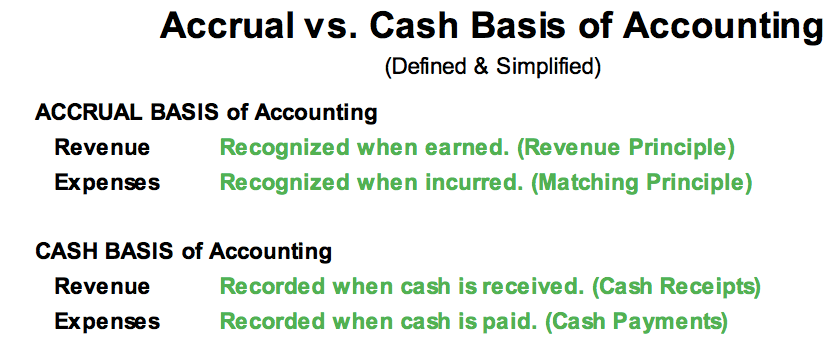

The video concludes by highlighting the difference between an accrual basis of accounting and a cash basis of accounting.