Summary Text

It has been my experience that those new to financial models generally find the LBO model intimidating. In my opinion, this is because most students or analysts are first exposed to more complex LBO models. This is generally done one of two ways:

- In a LBO tutorial that introduces a complex model for a publicly traded company.

- Or worse, presenting someone new to LBO models with a thorough LBO template that needs to be populated.

The first approach introduces too many concepts simultaneously, and the second approach reduces financial modeling to data entry. The purpose of this video is to demonstrate that a LBO model is not complicated. Don’t get me wrong, you can build highly complex LBO models. But this video will demonstrate that an LBO model is just an integrated financial statement model adjusted to reflect a transaction. To reflect the transaction you must add three components:

- Source and Uses

- Balance Sheet Adjustments

- Exit Analysis

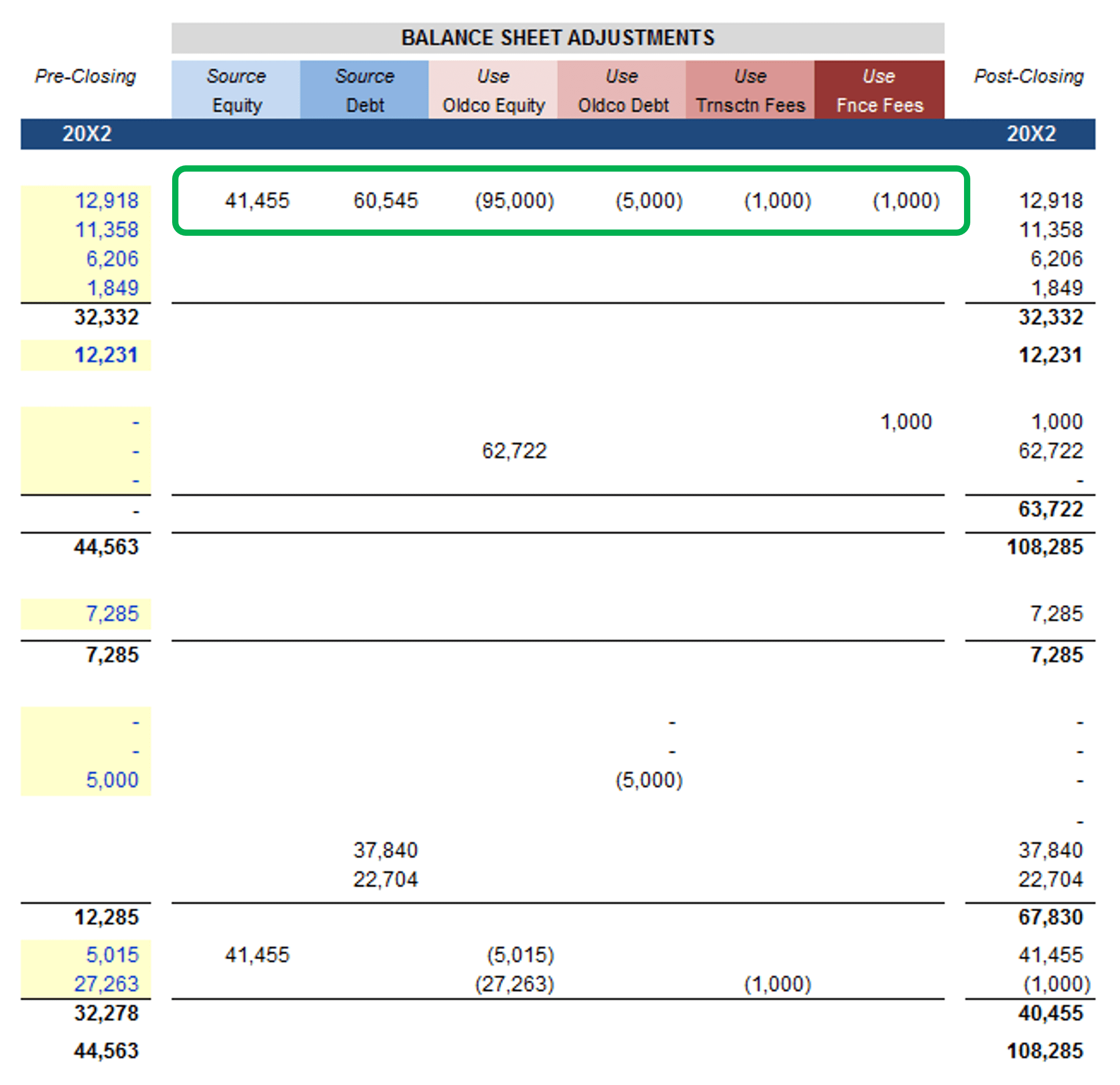

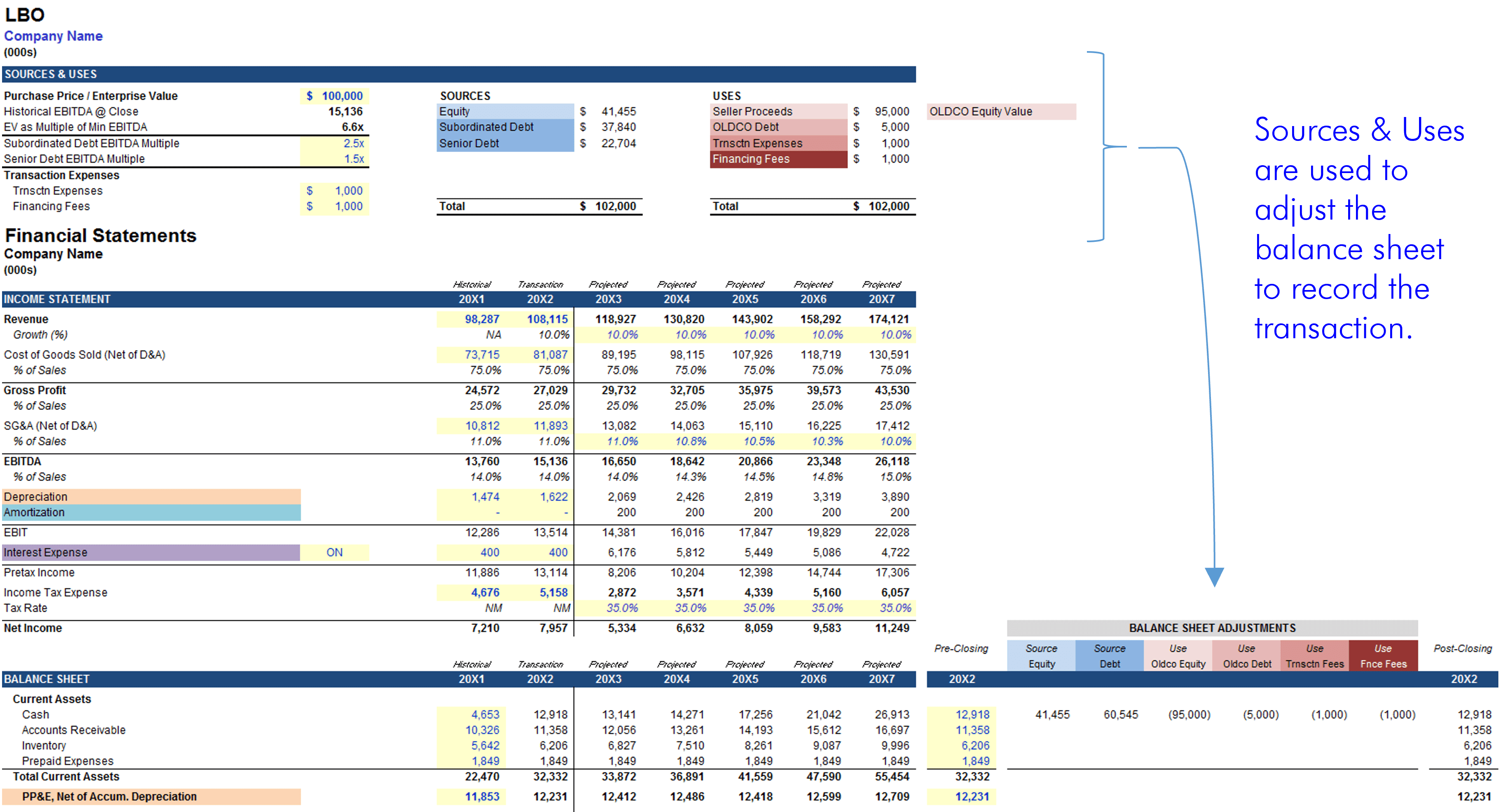

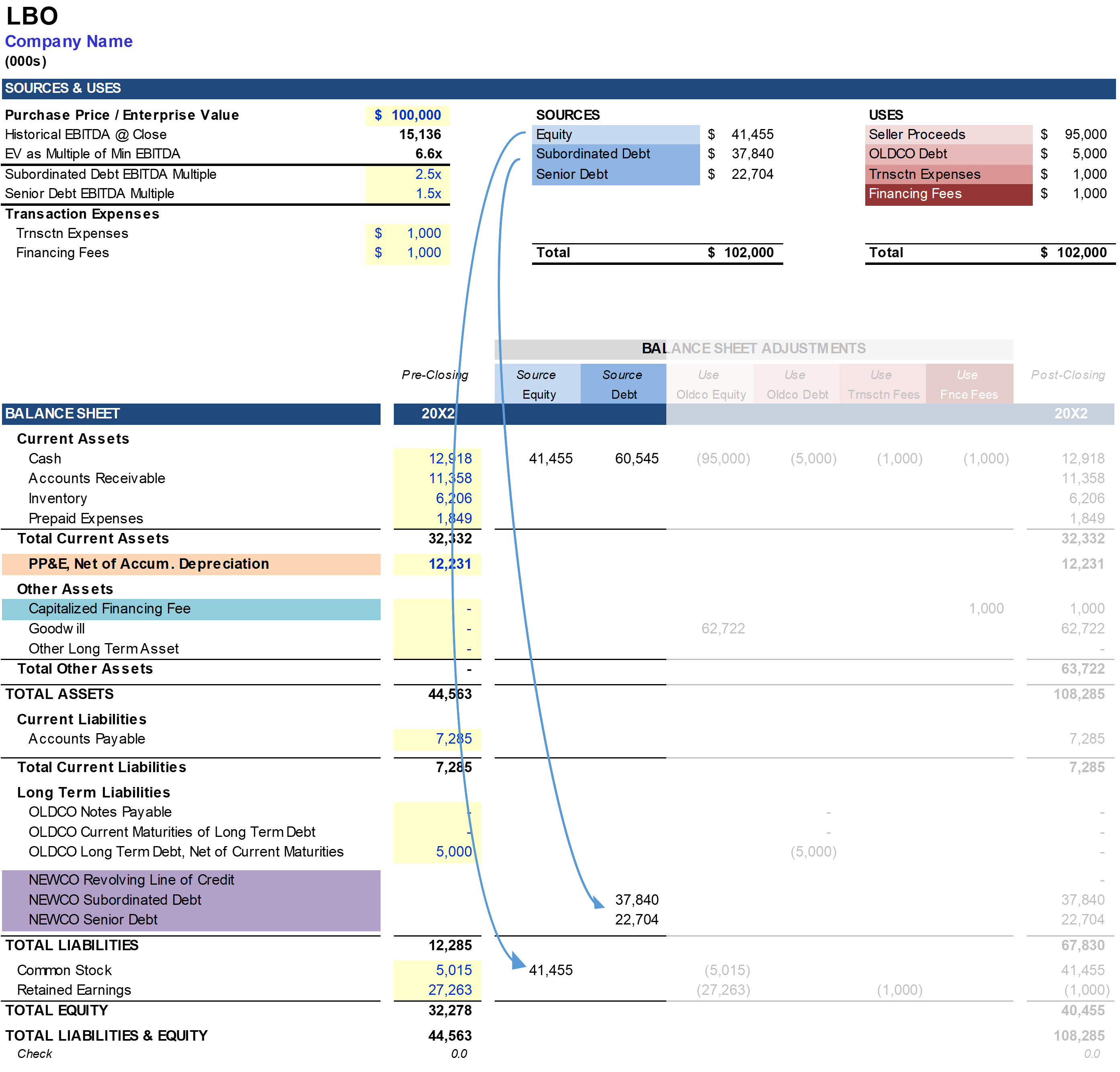

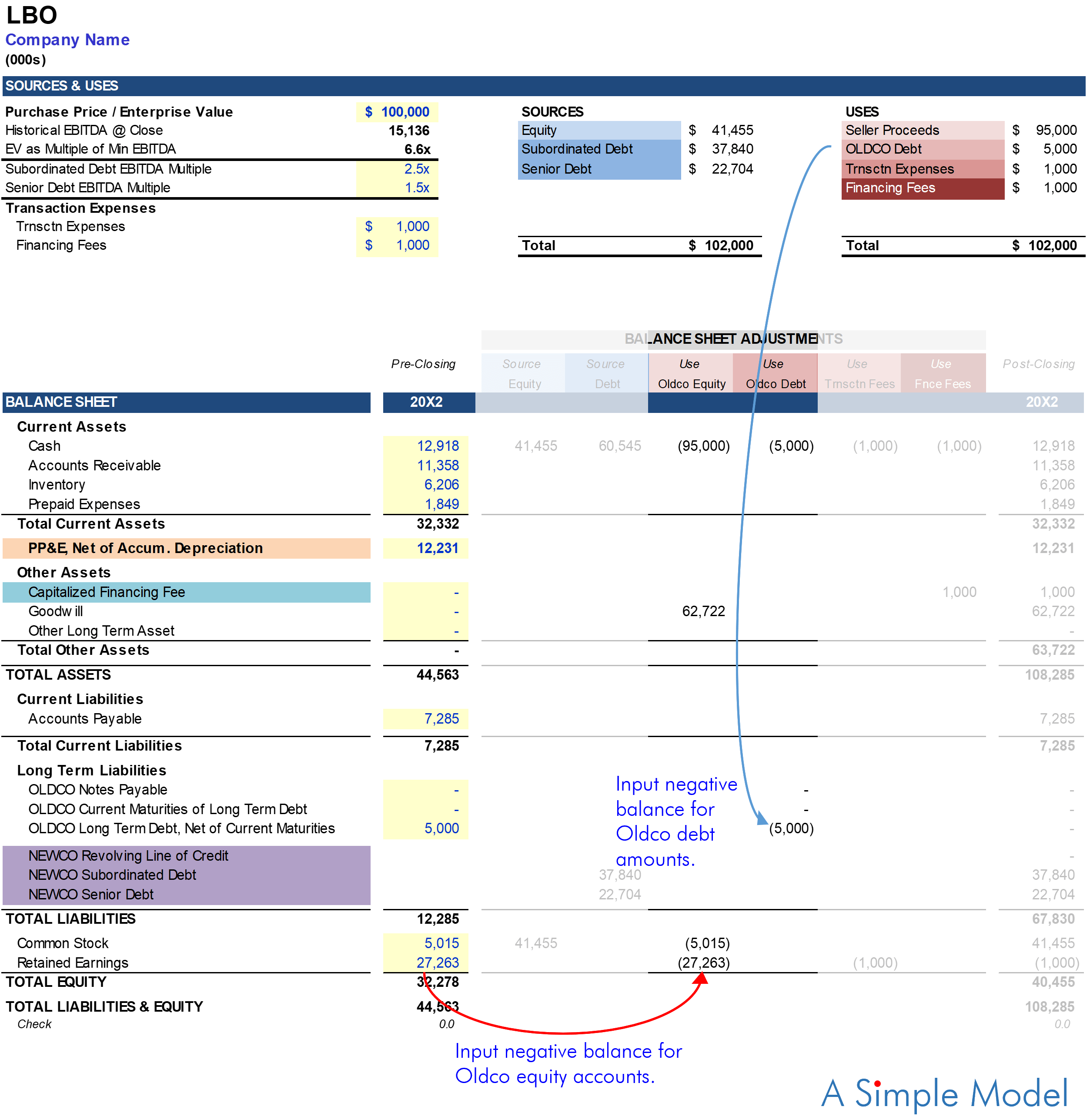

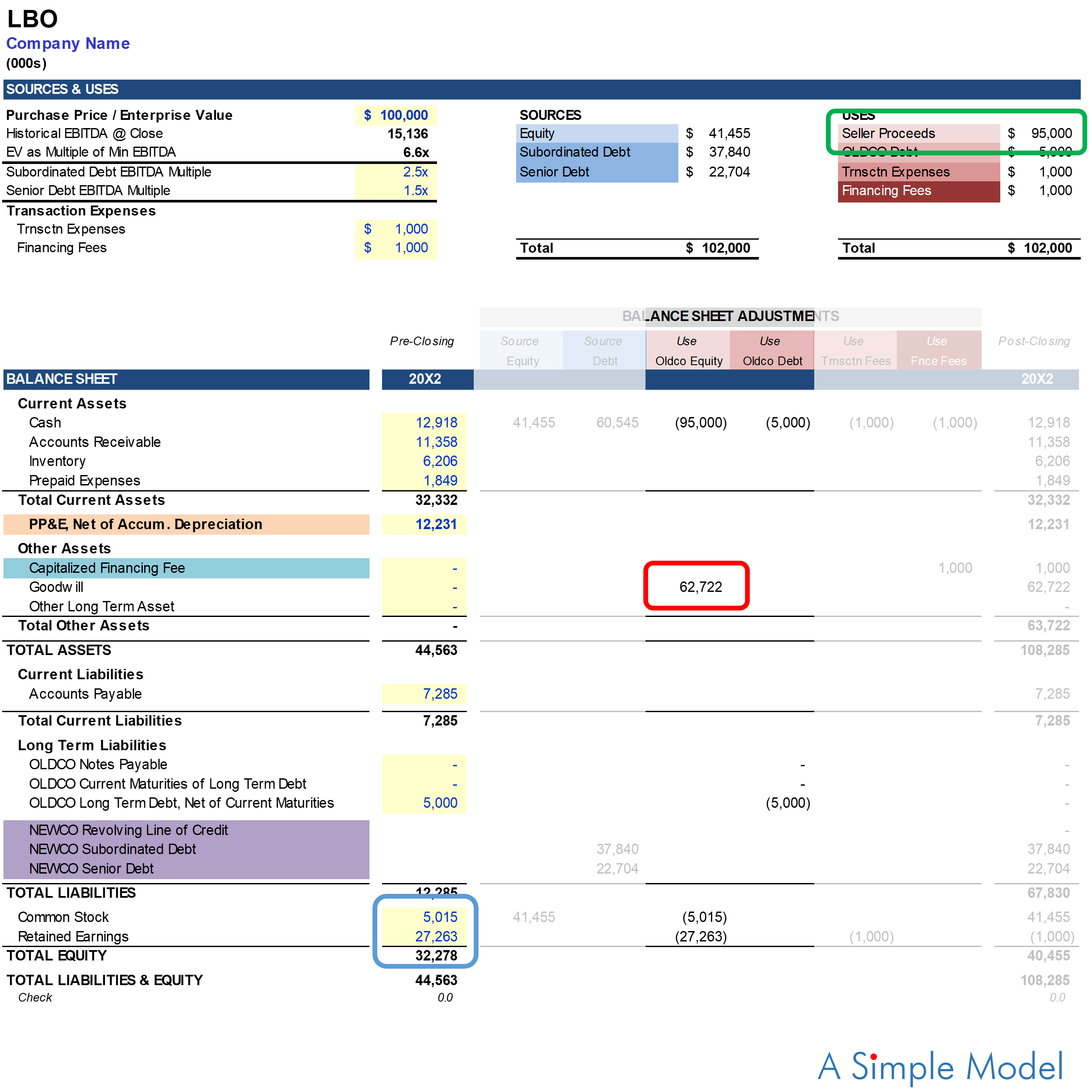

Numbers one and two above will have an impact on your integrated financial statement model. These two components are used to record the transaction taking place in your model. How does this work? First, Sources and Uses are used to calculate your Balance Sheet Adjustments:

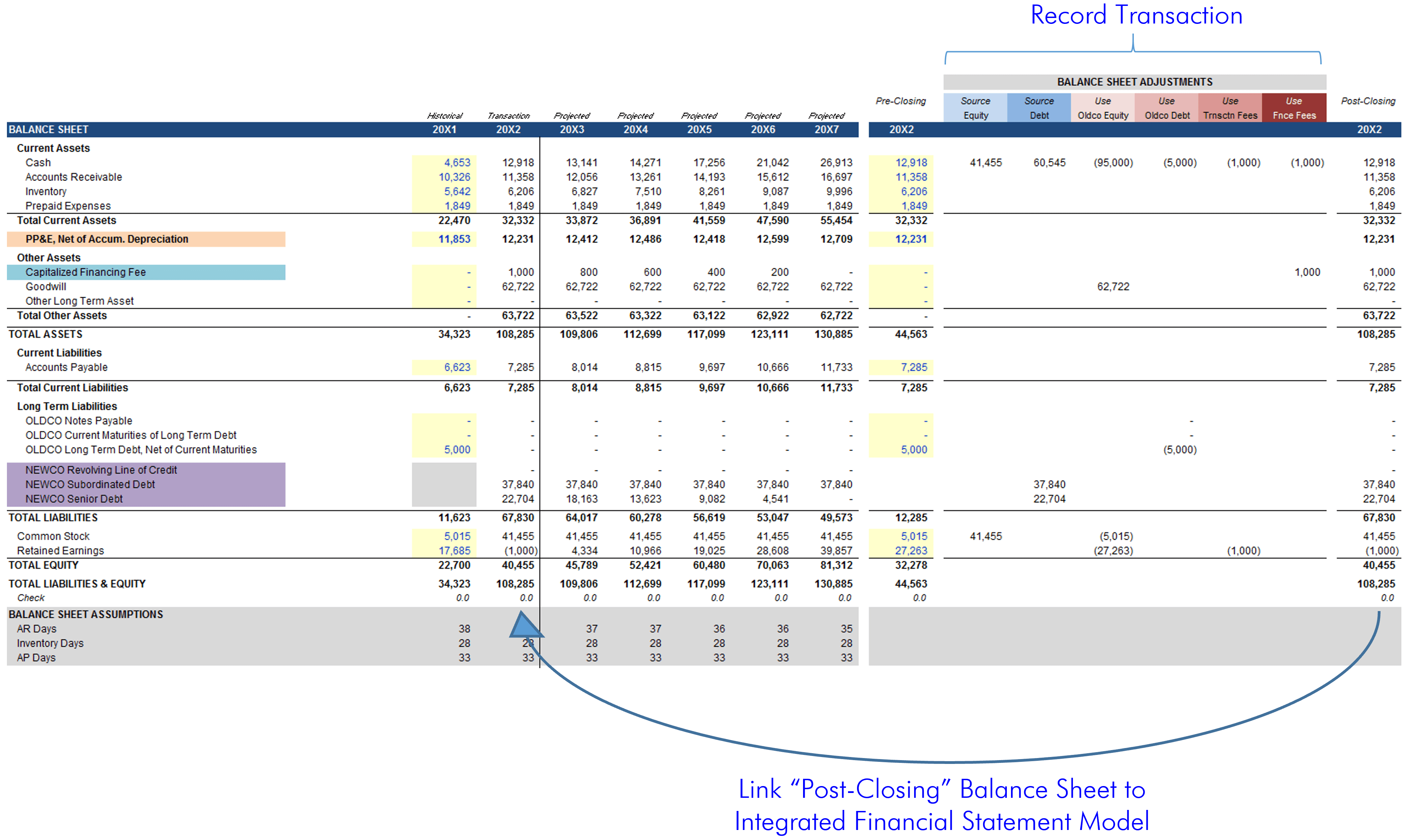

Once the transaction has been recorded under Balance Sheet Adjustments, the “PostClosing” balance sheet is linked directly back to your integrated financial statement model.

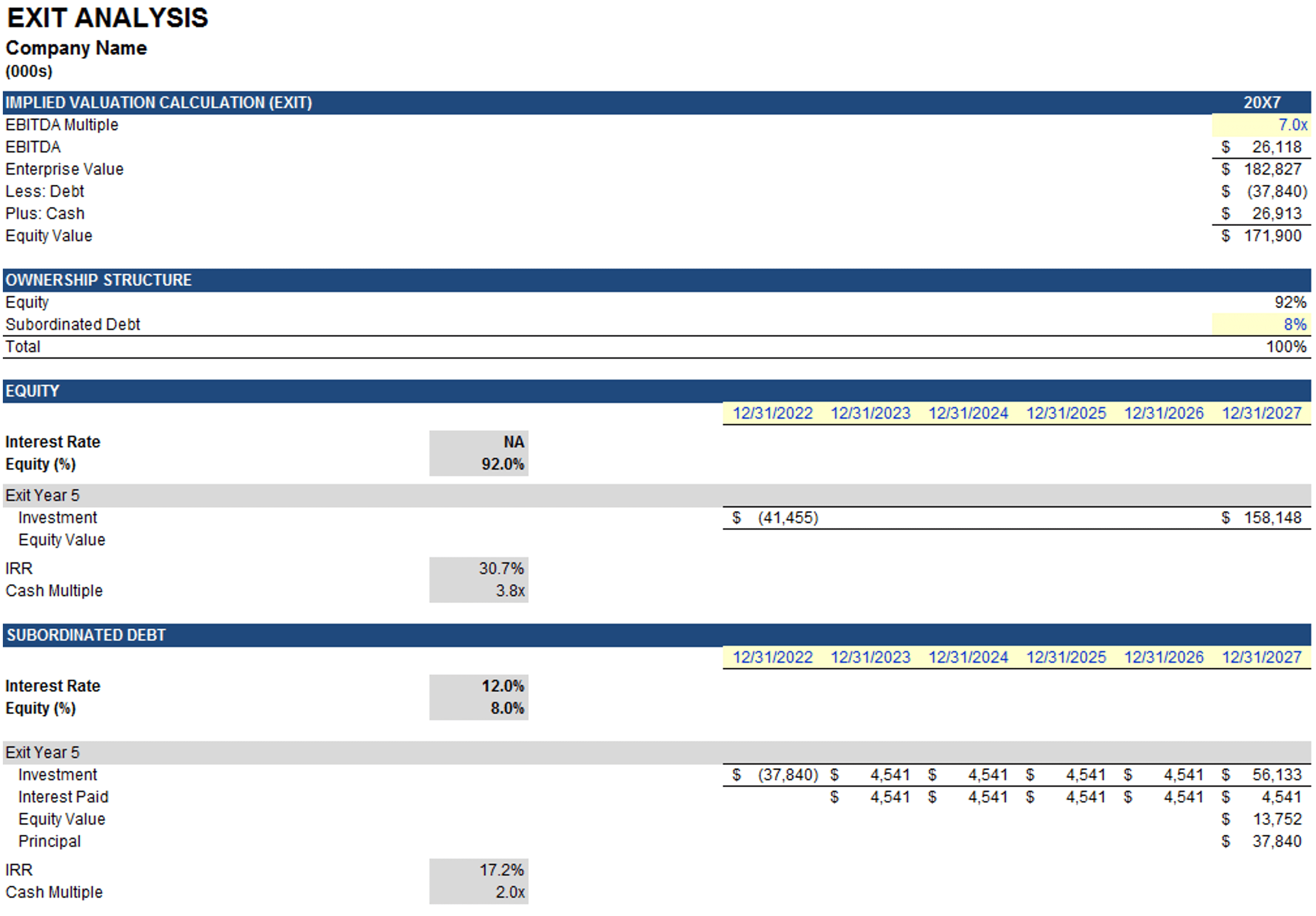

This may sound crazy, but that is the additional layer of complexity. Otherwise building an LBO model is nearly identical to building an integrated financial statement model. The only remaining difference is a few new balance sheet line items including the “Capitalized Financing Fee” and “NEWCO” debt items (see video). I realize we have not touched on the third component yet (“Exit Analysis”), but that is because this section is used to measure the performance of your investment. When you build this part of the model everything under “Exit Analysis” is pulling from the financial statements above. In other words, if you were to highlight and delete every cell under “Exit Analysis” it would not impact the model above. The same cannot be said for “Sources and Uses” or “Balance Sheet Adjustments.” So with that said, let’s take a closer look at the third component listed above, the “Exit Analysis” section of the model:

What you may notice is that there is not much to it (not in this model at least). The ultimate purpose of this analysis is to measure the performance of your investment, and recall from the video that in this model you represent the equity. To measure the performance of your equity investment you must include three things in your exit analysis:

- Valuation of the company at exit: “Implied Valuation Calculation (Exit)”

- A capitalization table: “Ownership Structure”

- The tranches of the capital structure you wish to measure: “Equity” and “Subordinated Debt”

You may be asking why you would include “Subordinated Debt” in your analysis if you are only investing in the equity. In this model, in order to achieve your equity return, you must have a subordinated debt provider, and to do that you must present something sufficiently attractive to the gatekeeper of this source of capital (the video elaborates on this).

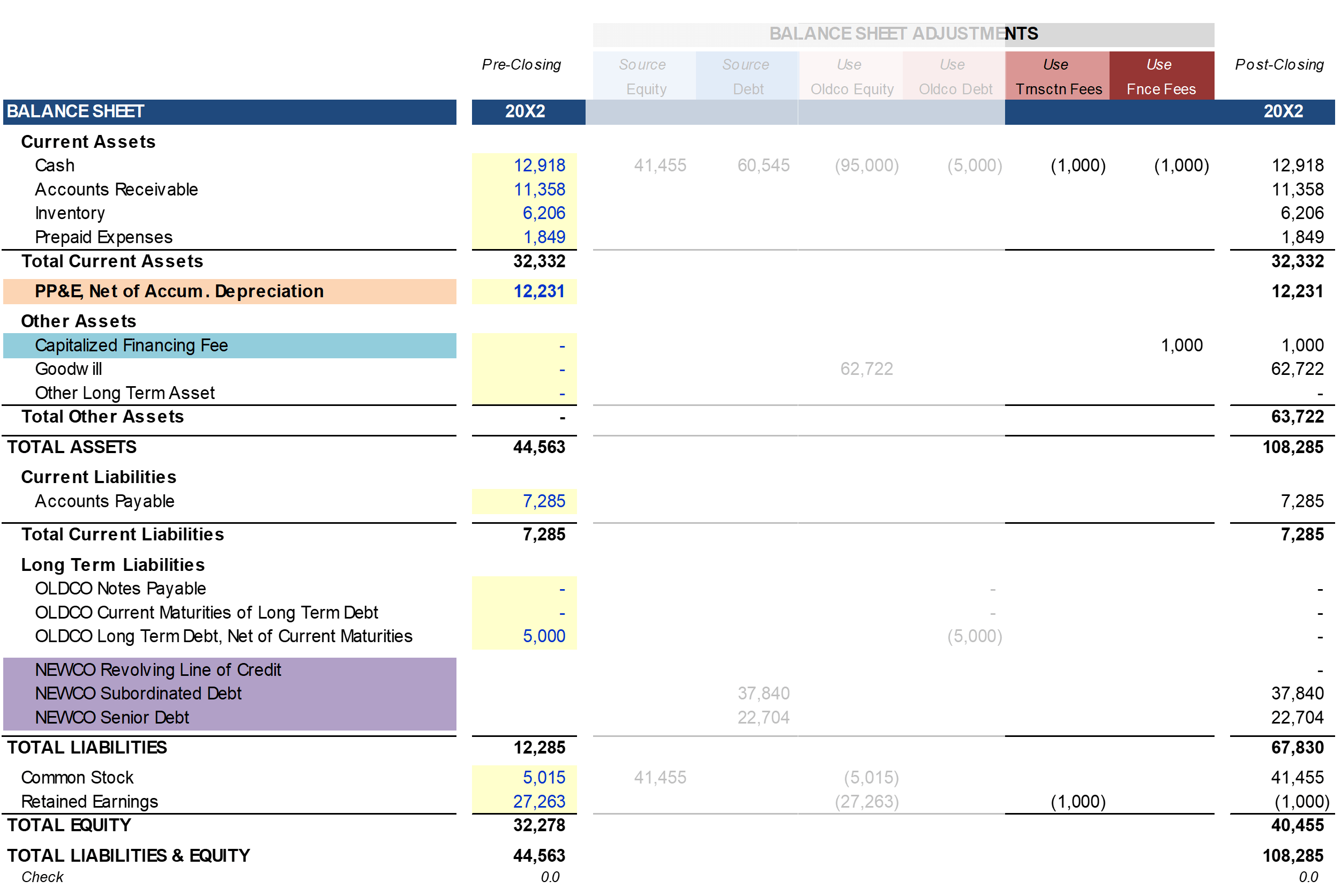

This video is largely focused on the balance sheet adjustments and calculation of goodwill. To emphasize the significance of these adjustments, the video will largely focus on the portion of the model pictured below.

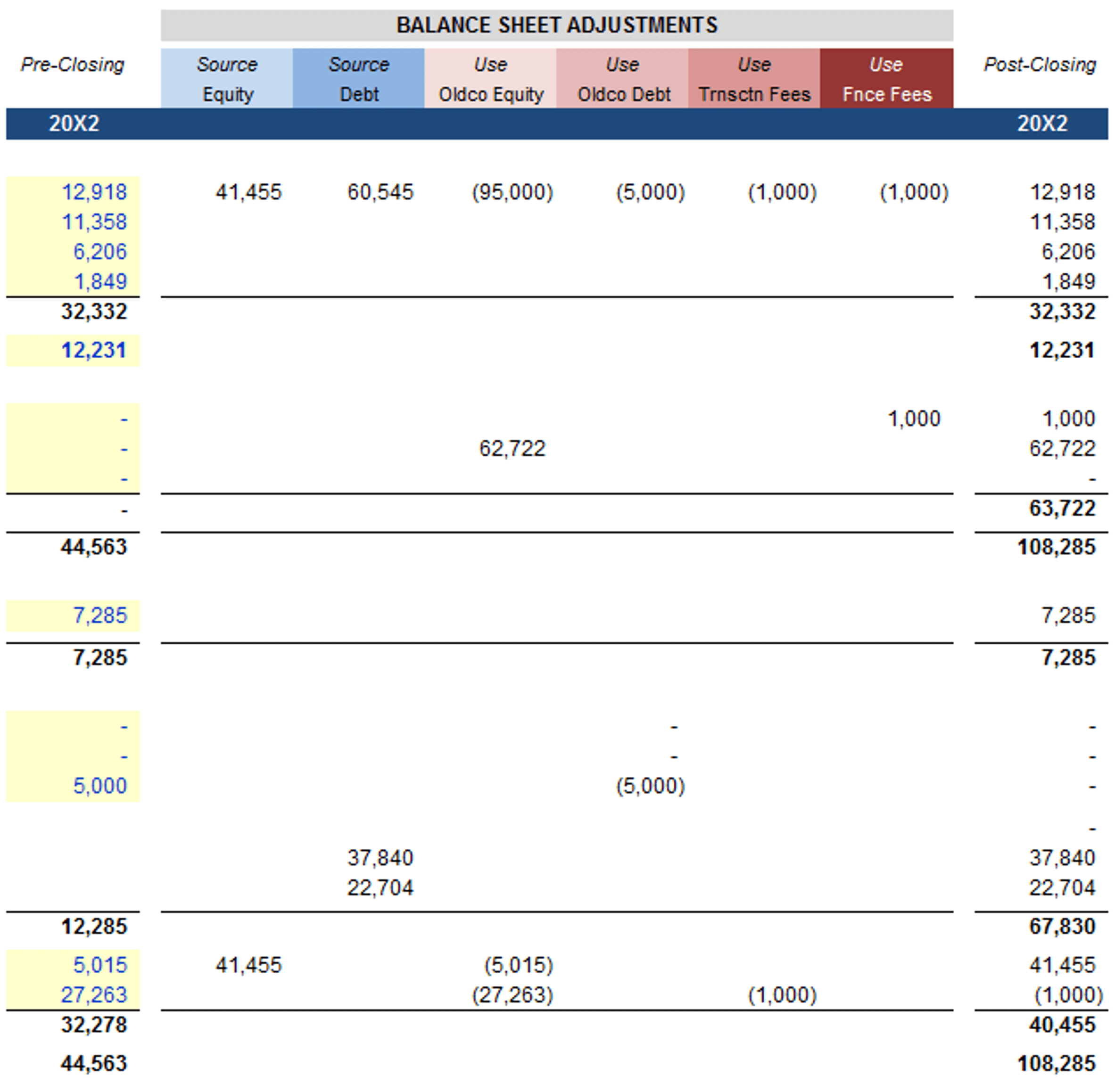

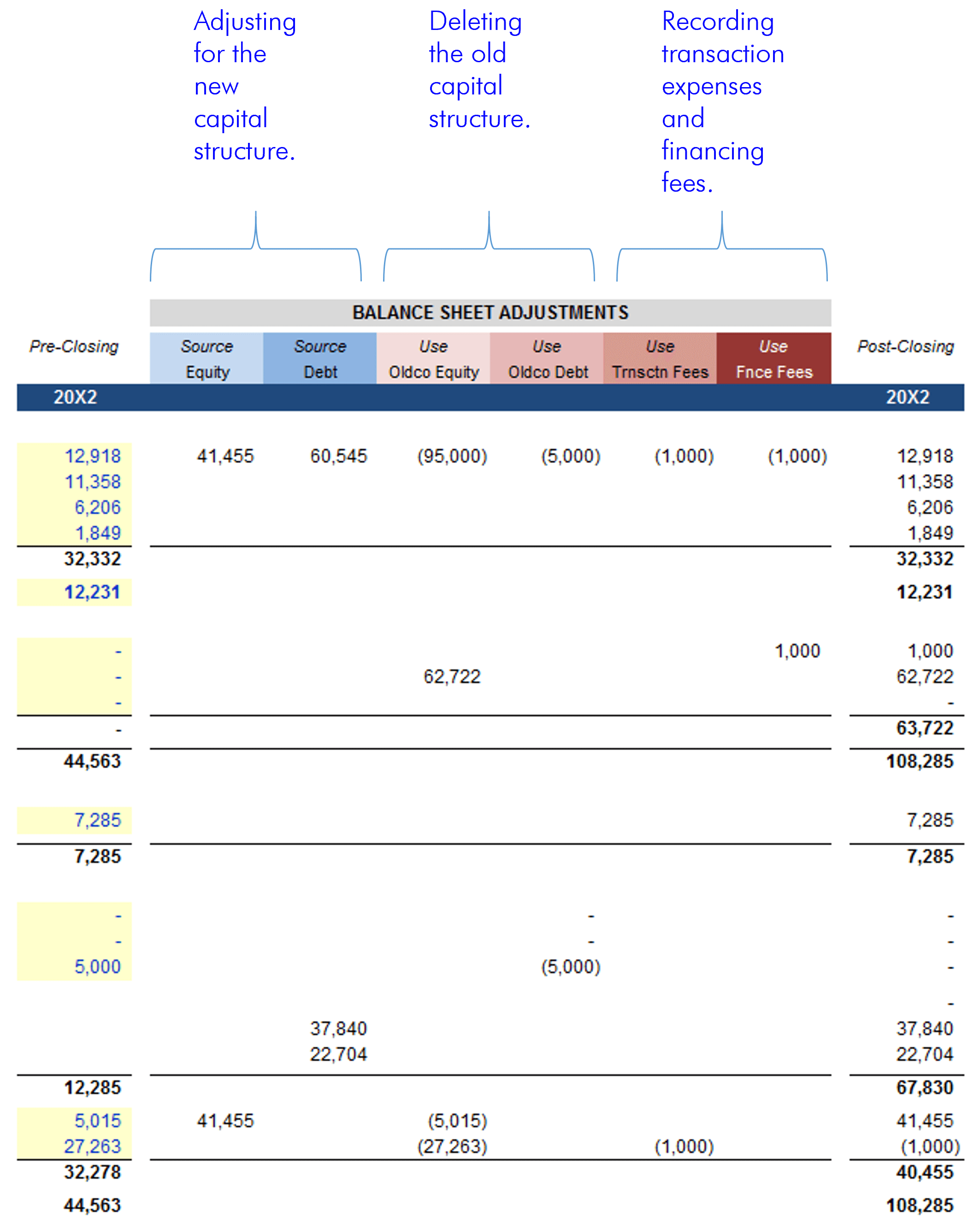

Everything about the process of building a “Simple LBO” is fairly straightforward with the exception of the balance sheet adjustments. To make sense of the six columns and multiple entries that comprise the balance sheet adjustments the video groups the columns into pairs. It is much easier to think about all of these changes in three categories:

Lets take these one at a time starting with the first two columns: “Adjusting for the new capital structure.” To record the new capital structure you must include all sources listed: Equity, Subordinated Debt and Senior Debt. This reflects the new ownership (equity) of the business, and the debt used to finance the transaction (subordinated debt and senior debt).

With the new capital structure established the next step is to delete the old capital structure, which brings us to the middle two columns: “Deleting the old capital structure.” The first step is to delete the oldco equity accounts (red arrow). (Recall that in the previous two columns the new ownership was recorded.) The second step is to delete the oldco debt (blue arrow).

This brings us to the calculation of goodwill. In a transaction goodwill can be defined as the value of the purchase price in excess of net identifiable assets. Here “purchase price” refers to Seller Proceeds (can also be thought of as oldco equity) of $95M. In the video net identifiable assets is defined as assets less liabilities, which if you recall from the accounting equation is equal to stockholder’s equity (A – L = SE). It follows that Goodwill is equal to $95M - $32.278M = $62.722M (color coded below).

The last two columns are used to record transaction expenses and financing fees. As the video mentions transaction expenses are expensed, and financing fees are capitalized. When a sum is expensed it reduces stockholder’s equity (please see reference note: Accounting Equation). For that reason you will see stockholder’s equity reduced by $1M of Transaction Expenses. Financing fees are capitalized and therefore the sum of $1M appears on the balance sheet as an asset. The logic behind this is that the fee will be amortized over the life of the loan. To understand this it helps to think about the way depreciation works. In the same way that the purchase price of equipment is spread out over the useful life of the equipment, here the fee associated with a loan is spread out over the life of the loan.

To keep the balance sheet balanced as these adjustments are recorded, sources are recorded as positive balances under cash, and uses are recorded as negative balances under cash (see green rectangle). And because sources are equal to uses the net effect on cash is zero.

NOT MENTIONED IN VIDEO: Most transactions are contemplated on a “

cash-free debt-free” basis. This means that the acquirer assumes control of the business with a cash balance of zero and oldco debt paid off (oldco debt is the sellers responsibility and most debt has change of control provisions which require repayment of principal in a control transaction). If you would like to show this transaction on a cash-free basis delete the cash balance of $12.918M and subtract the identical sum from stockholder’s equity on the “Pre-Closing” balance sheet.