Summary Text

In the event of a successful private equity transaction, a distribution waterfall defines how the proceeds will be distributed between the investors in the fund and the private equity firm. This video explains how a distribution waterfall works and walks through several examples to make the math simple to follow. The instruction, which is broken down into five parts, alternates between whiteboard examples and Excel templates.

The first three Excel templates work up to the most common private equity distribution waterfall.

The first Excel template shows only the preferred return to the investors, and then distributes 80% the remaining proceeds to the investors and 20% to the private equity firm (the “80/20 split”).

The second Excel template introduces a catch-up calculation. To make the math easier to follow, the catch-up is equivalent to 20% of the committed capital and the preferred return. This would be an aggressive compensation structure, but as the video demonstrates, makes for an easy transition to the third Excel template.

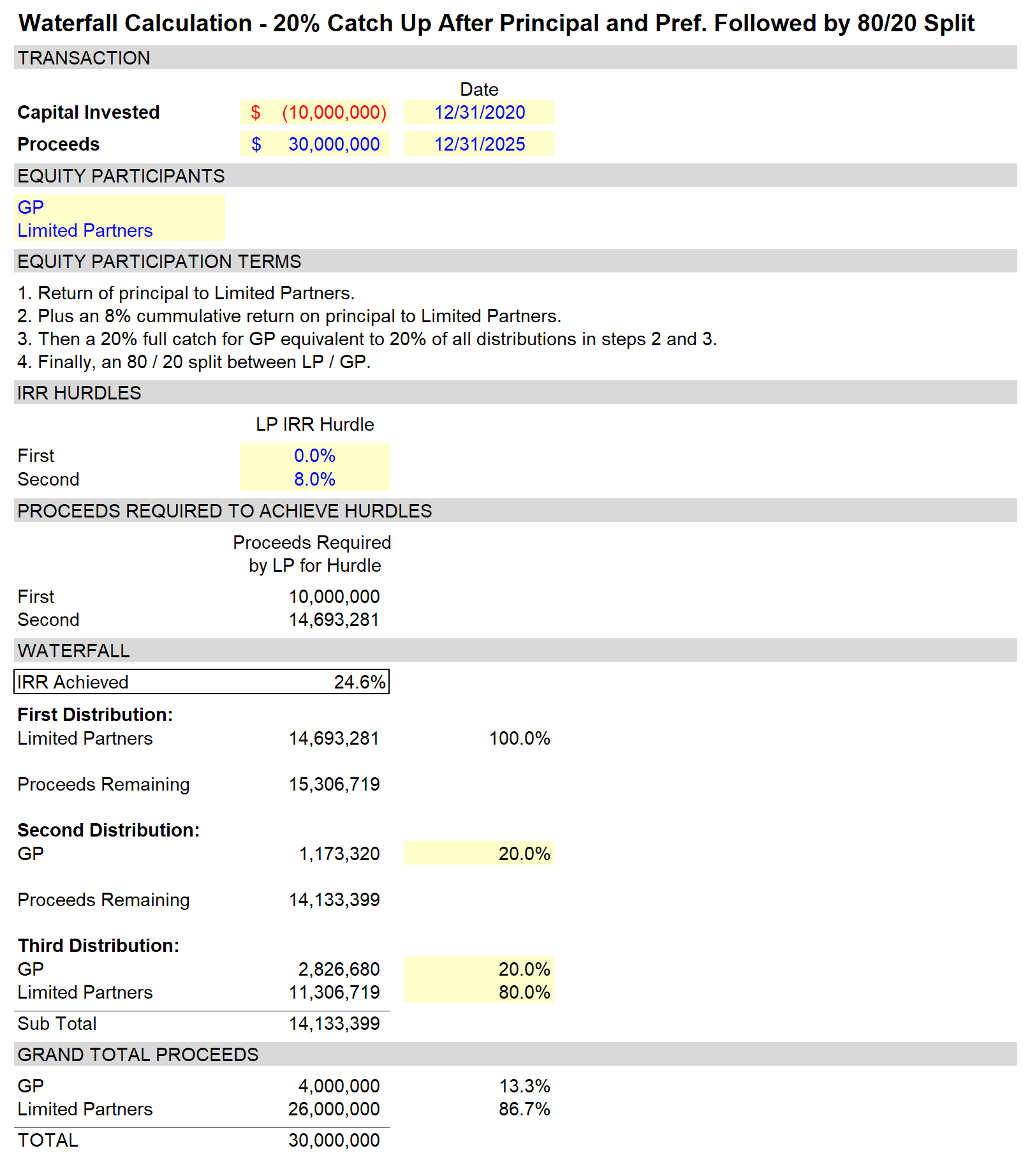

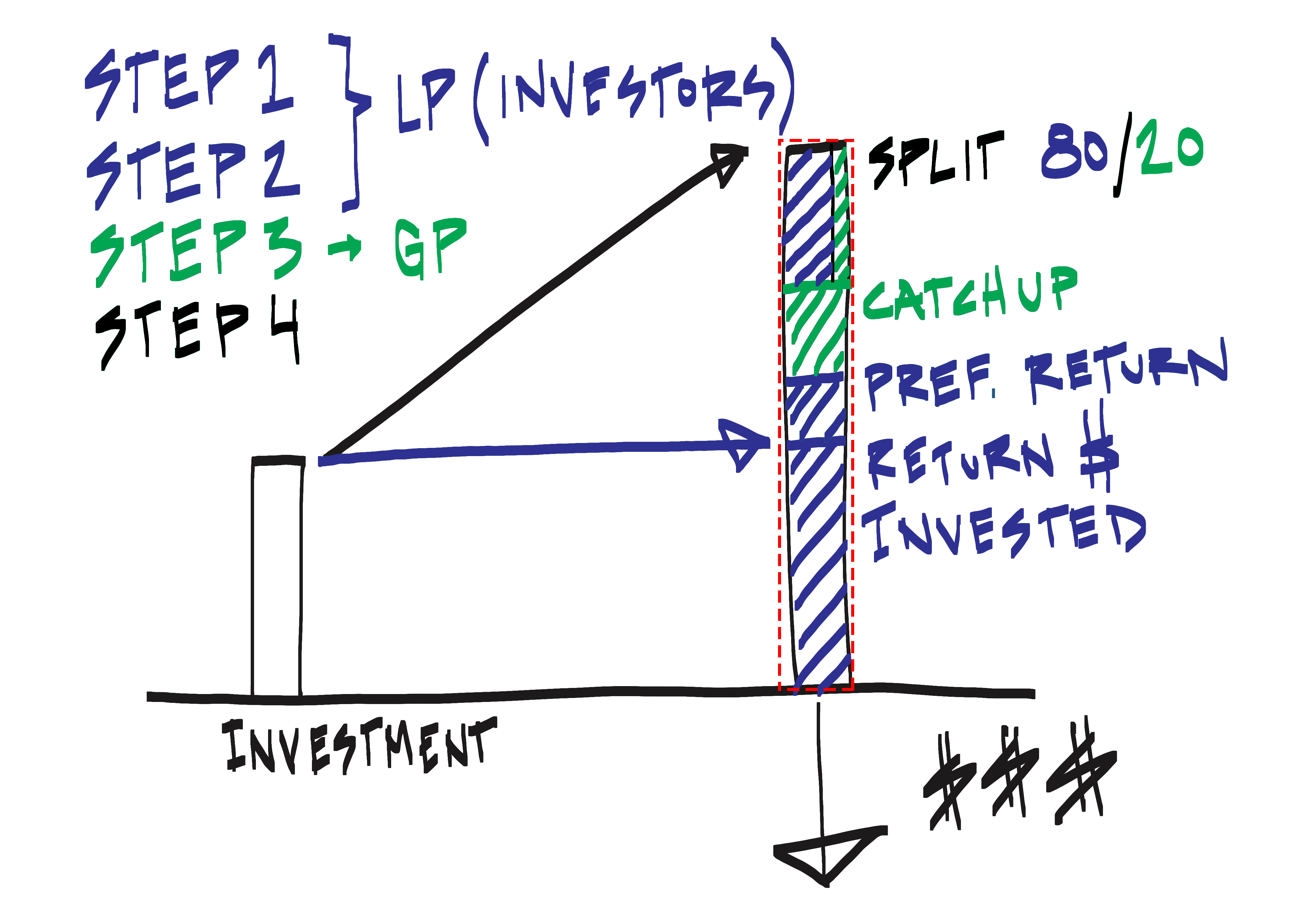

The third Excel template is the most common example of a distribution waterfall. The steps are outlined below:

- First, 100% of all cash inflows to the LP until the cumulative distributions equal the original capital invested.

- Second, 100% of all cash inflows to the LP until the LP has received a preferred return on the capital invested in step 1.

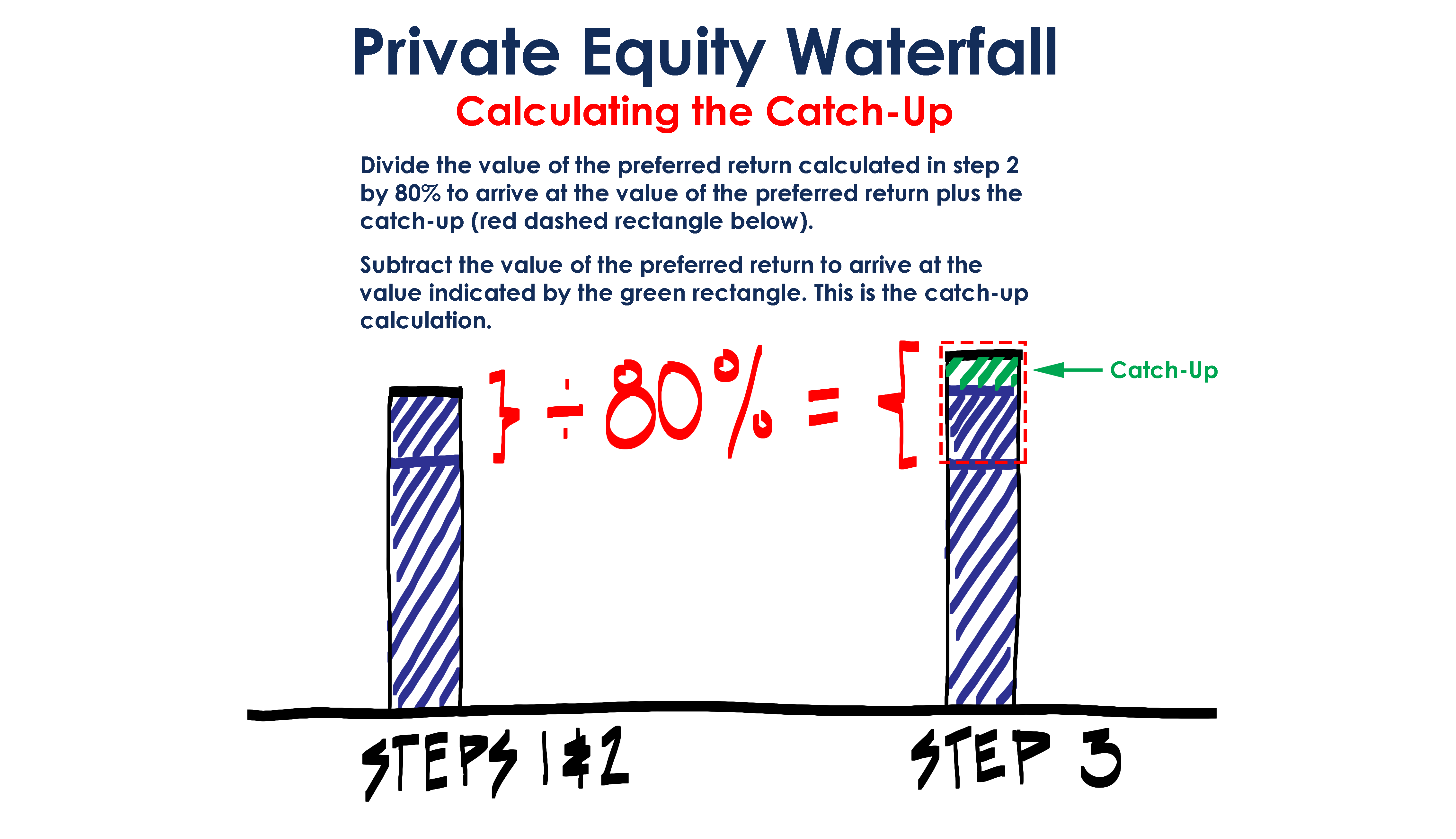

- Third, a "20% catch-up" to the GP equivalent to 20% of the distributions realized in step 2 plus the distributions realized in this step.

- Fourth, thereafter, cash flows in excess of distributions made in step 1, 2 and 3 (if any) are distributed 80% to the LP and 20% to the GP.

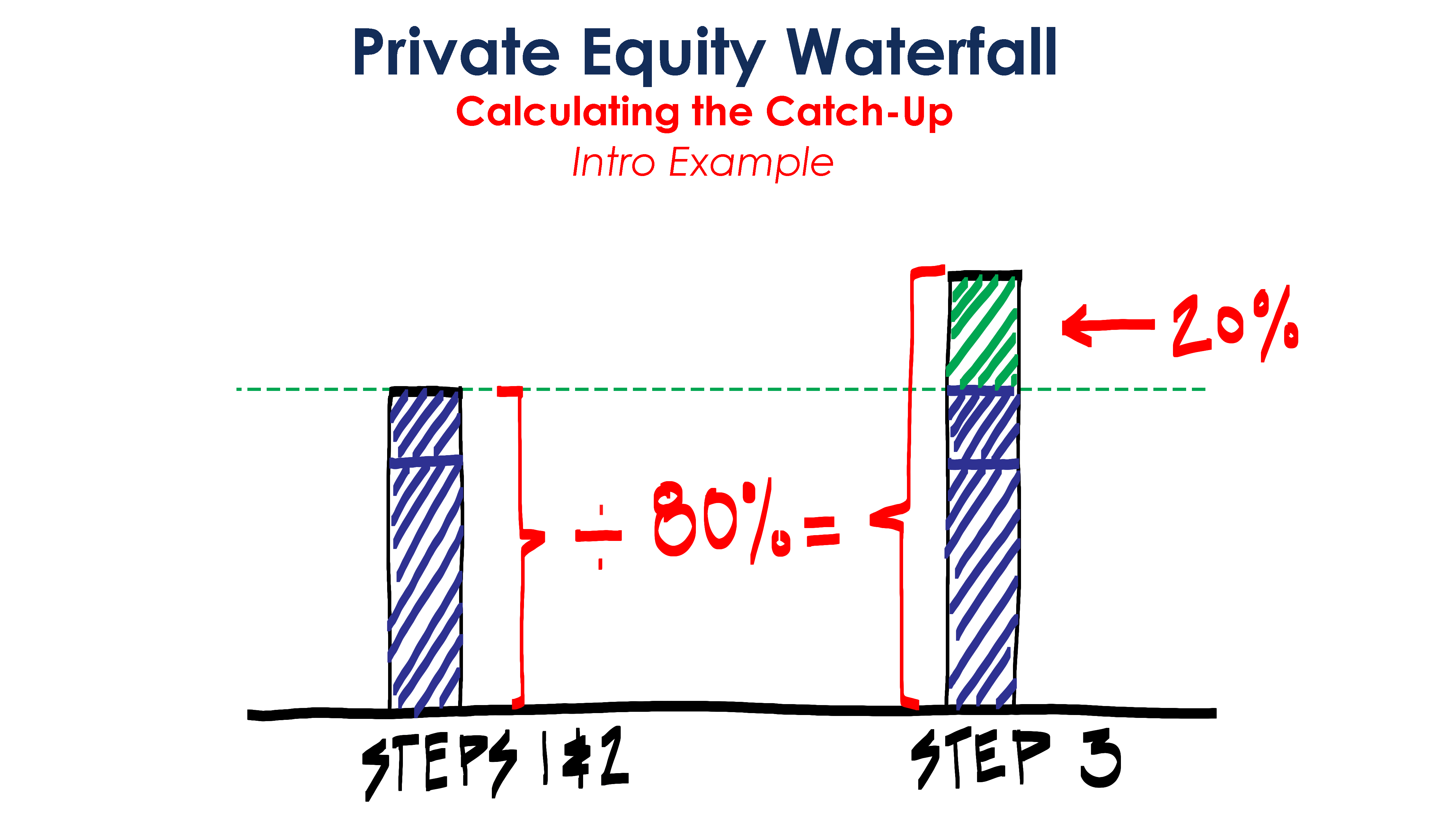

Private Equity Catch-Up Calculation:

This video focuses on the catch-up calculation to highlight that the math is simple. Those new to private equity occasionally struggle with this step on account of the vocabulary involved, which is why the second Excel template (described above) was included. This additional step first calculates the catch-up as 20% of steps 1, 2 and 3 from the four bullets above.

With this explanation as a reference, the third Excel template then introduces a catch-up calculation equivalent to 20% of distributions realized in steps 2 and 3.

The Excel template available for download includes all three examples referenced, plus two additional examples to demonstrate how additional variables can be included.