LBO Pro Forma Balance Sheet Adjustments

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control transactions.

The

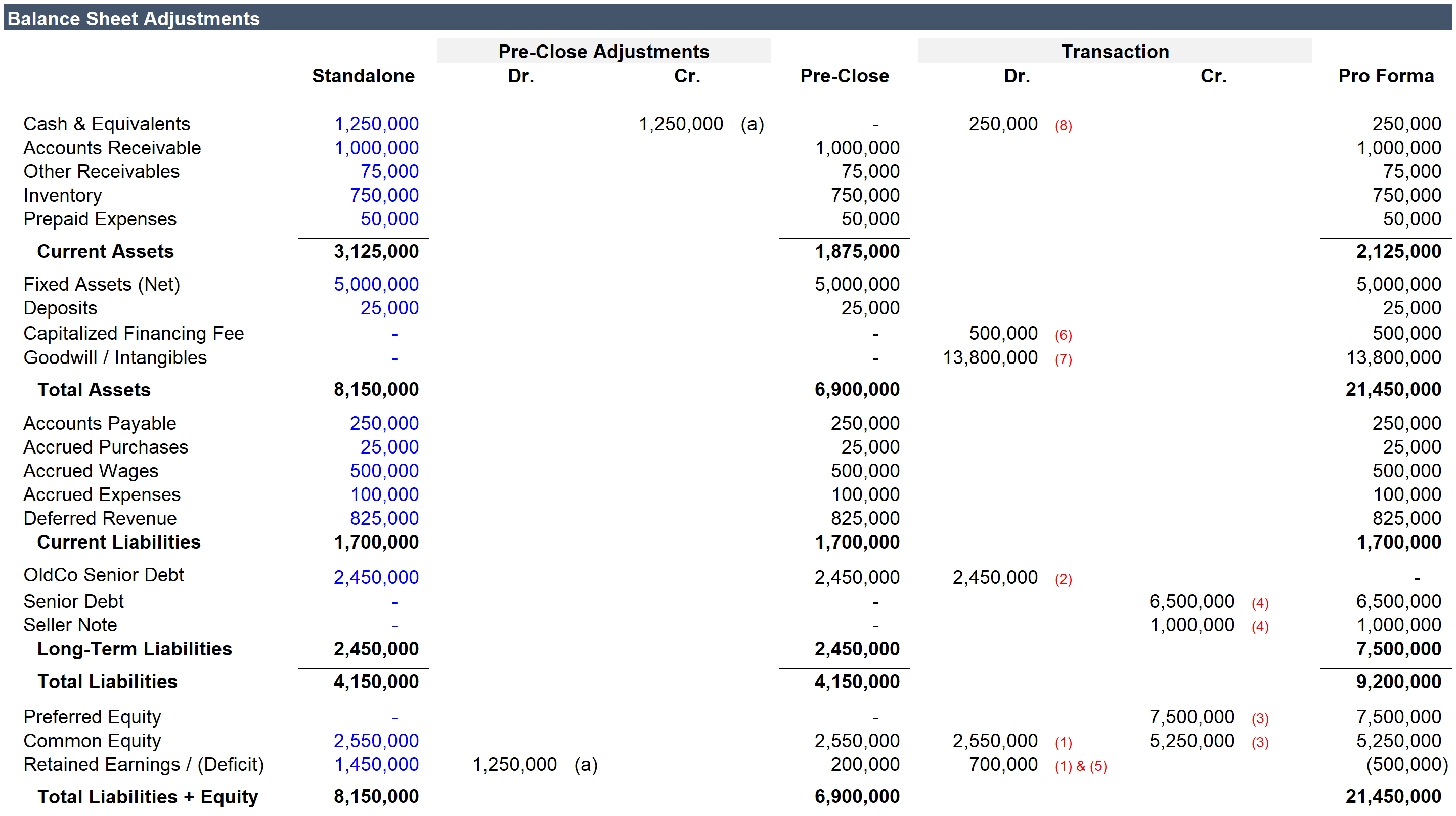

template available for download reflects the elimination of cash under Target Company Adjustments below and all of the Purchase Price Adjustments. These are items that will be required in almost every transaction. The remaining items listed under Target Company Adjustments may or may not be required.

Note: This post does not contemplate situations where the purchase price is not a premium to the net identifiable assets (i.e. negative goodwill).

This post is divided into two parts:

- Target Company Adjustments: Adjustments made to prepare the target company’s balance sheet for the transaction.

- Purchase Price Adjustments: Adjustments made to record the acquisition of the target company.

-

TARGET COMPANY ADJUSTMENTS

The list that follows is not comprehensive, but instead focuses on the most common adjustments that might be required to prepare the target company’s balance sheet for a transaction.

Eliminate Cash for a Cash-Free Transaction: Most transactions are contemplated on a cash-free basis, which is to say that the sellers intend to keep the cash. To reflect this change eliminate cash on the balance sheet and reduce retained earnings by the same amount.

Debit: Retained Earnings

Credit: Cash

Eliminate Old Goodwill: The purchase price is allocated to the net identifiable assets of the company. Goodwill, which is not an identifiable asset, is eliminated to facilitate the calculation of net identifiable assets. To reflect this change eliminate goodwill on the balance sheet and reduce retained earnings by the same amount.

Debit: Retained Earnings

Credit: Goodwill

Move Current Portion of Long-Term Assets and Liabilities to Long-Term Balance: The most common example relates to long-term debt. If a target company shows a senior debt balance under liabilities it is likely that the amount of principal amortization due that year will appear under Current Portion of Senior Debt as a current liability. To reflect this change eliminate the current portion and add it to the long-term balance.

Debit: Current Portion of Senior Debt

Credit: Senior Debt

Adjusting Assets and Liabilities to Fair value: This can apply to nearly any asset or liability on the balance sheet, but in this post we are only going to focus on Accounts Receivable and Inventory.

Accounts Receivable: If you believe the AR balances might not be collected an adjustment may be required.

Debit: Retained Earnings

Credit: Accounts Receivable

Inventory: If the business has been poorly managed it is possible that the inventory balance will not be accurate. If it is overstated it should be written down.

Debit: Retained Earnings

Credit: Inventory

If inventory is understated and needs to be written up the tax consequences need to be considered.

Debit: Inventory

Credit: Deferred Tax Liability (Amount Written Up x Tax Rate)

Credit: Retained Earnings (Amount Written Up x (1 – Tax Rate))

PURCHASE PRICE ADJUSTMENTS

By accurately adjusting the Target Company balance sheet for the items described the calculations for the purchase price adjustment are made simple. The first objective should be to identify the sources of capital used to make the acquisition. Once you have these figures totaled you can subtract all uses to arrive at Seller Proceeds. For example:

This makes the goodwill calculation pretty straightforward. Goodwill is equal to Seller Proceeds less the net identifiable assets of the target company. Net identifiable assets is equal to identifiable assets less liabilities, which per the accounting equation is equal to shareholders’ equity.

With these values calculated we can make the required balance sheet adjustments. To provide context, I think it is helpful to think about this in the following steps (

download the template to work through the list):

- Eliminate OldCo Equity Accounts

- Eliminate OldCo Debt Balances

- Add NewCo Equity Accounts

- Add NewCo Debt Balances

- Expense Transaction Expenses

- Adjust for Financing Fees* (see note at bottom of post)

- Add Goodwill Calculation

- Add Cash at Close

-

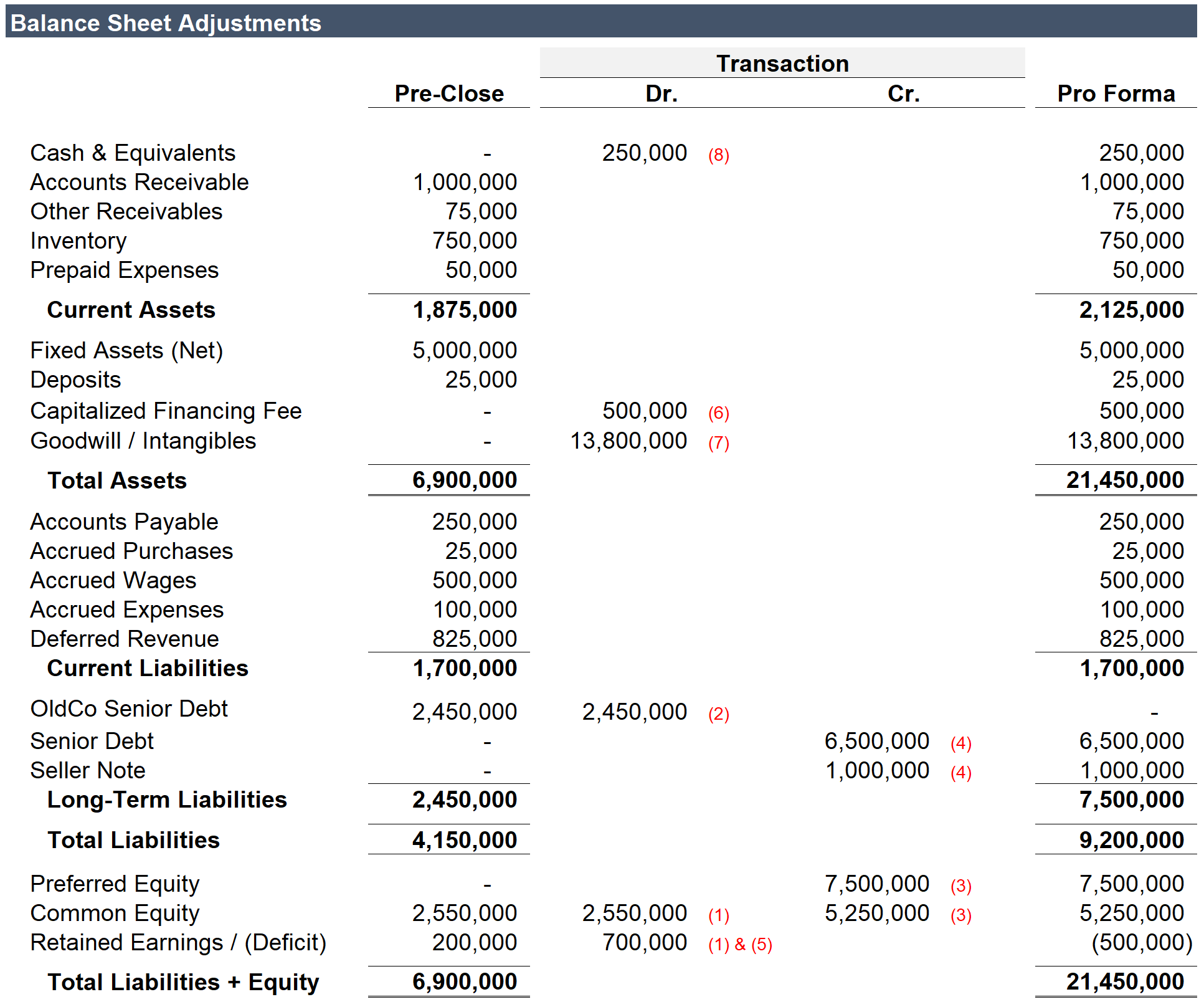

Full Balance Sheet Adjustments Image (click on the image for fullscreen view):

VIDEO DEMONSTRATION (using the LBO Case Study as an example):

NOTES:

- Under GAAP the financing fee is no longer on the asset side of the balance sheet. A recent accounting update requires that this sum be subtracted from the corresponding debt line item. I prefer to see the total principal balance outstanding on the balance sheet and continue to use the old approach for this reason. You can find a video covering the update here (subscriber content).